When it comes to running a great business that is successful and turns a profit, you have to be able to accept payments easily and quickly. That means investing in something like integrated card services. As small business owners, you might already understand the importance of creating a solid point of sale system (POS) for your business. Just in case you do not, however, let’s take a look at the basic POS requirements for a small business. Understanding these aspects can help you select the right service provider for your needs.

Integrated Card Services

Running a small business can be a difficult prospect, especially when you are just starting out. You are probably concerned about how to get your business set up so that it runs smoothly. To help create a business environment that will allow you to thrive, make sure that you set up a solid POS system to help capture your payments and direct them where they need to go. Making use of integrated card services can greatly help in this effort.

The Right Technology & Price

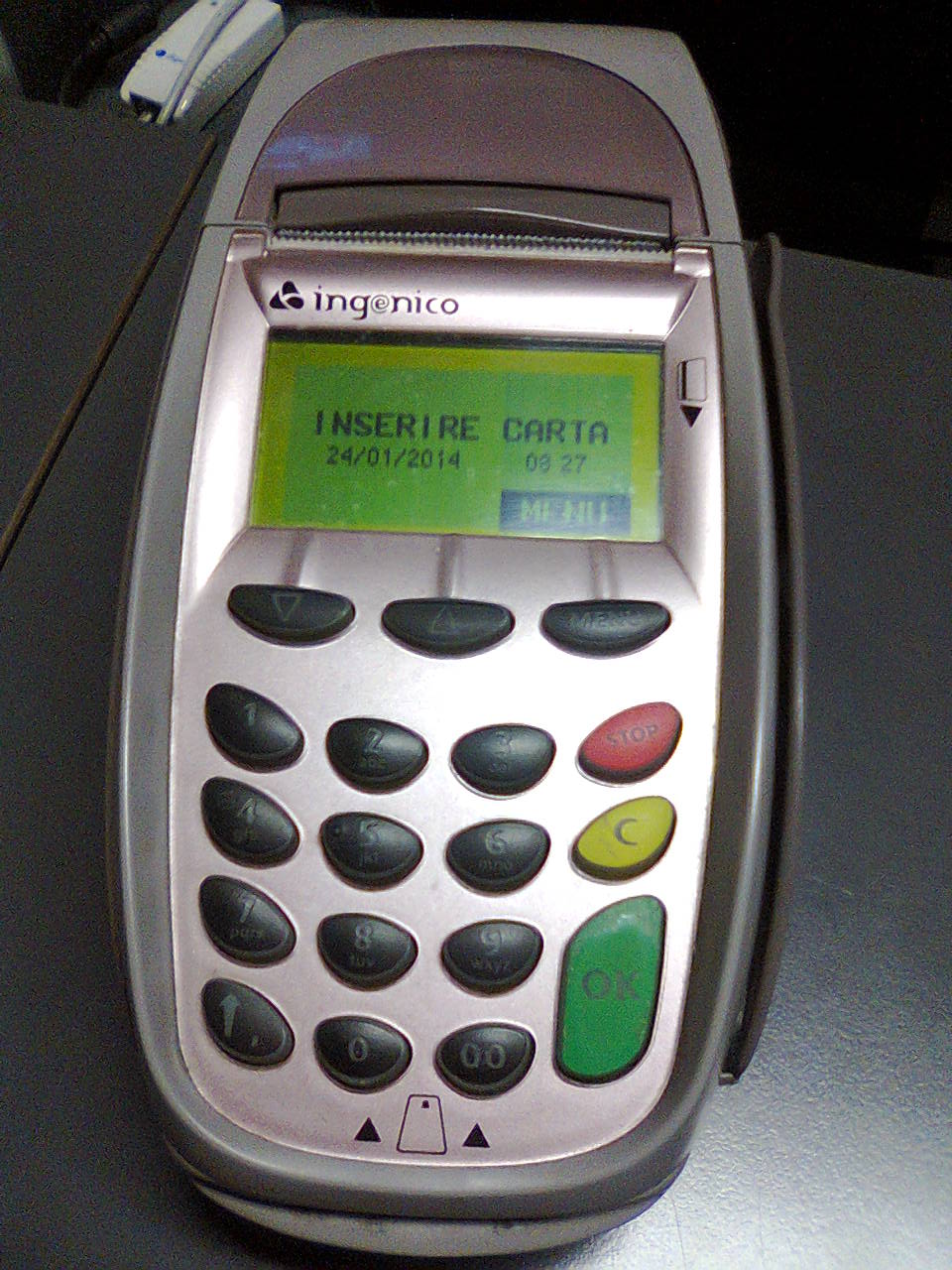

In addition to making use of the aforementioned services, take your time when selecting a service provider and make sure they offer the technology you need at a price that you can afford. Being able to take advantage of things like a wireless credit card reader, for example, can greatly help you ensure that your business succeeds. Additionally, be careful when selecting a plan and take a good look at the processing fees you will be paying per transaction. For the best profit possible, pick a provider that offers the lowest credit card processing fees around.

For more information about how to select the right service for your needs, contact Merchant Account Solutions today! They can help get your POS system up and running.